-

Company Information

Company Name Shoji Investor Relations Advisors Limited Liability Company Established November 2009 Registered Head Office Otsuka 6-34-7, Bunkyo-ku, Tokyo 112-0012, Japan Documents should be sent to this address

Business Office 3rd Floor, Minami-Otsuka 2-11-10, Toshima-ku, Tokyo Access 1 minute walk from Shin-Otsuka station Exit 2, Tokyo Metro Marunouchi line TEL +81-3-6630-6040 -

Our Mission & Proposition

Our Mission

“To Promote Greater Value Creation”

The Issues:

Faced with limited growth prospects in the home market due to declining demand, companies have no choice but to venture overseas for business growth. However, this challenge can present unsurmountable barriers for many companies who do not have the proper resources to deal with the realities of the cross-border experience.

Faced with limited growth prospects in the home market due to declining demand, companies have no choice but to venture overseas for business growth. However, this challenge can present unsurmountable barriers for many companies who do not have the proper resources to deal with the realities of the cross-border experience. One must consider barriers stemming from diverse languages and cultures, the need to recognize proper market penetration and effective strategies, familiarity with investor availability and sourcing, arrangement of cost effective long-distance management and administration, and more. If these obstacles are not overcome, these important elements to your overseas expansion preparation could escalate into serious shortcomings. In addition, with ongoing technological innovation and increased commoditization of products, companies may suffer further setbacks, as their business, financial, and investor strategies become increasingly disconnected. Ultimately, a lack of proper guidance could lead to corporate value destruction.

Our Proposition

Since 2009, the advisors at Shoji Investor Relations have developed an evolved skill set from hands on experience accumulated over decades. These skills are needed to guide your company through the overseas challenges, and resolve your strategic problems in order to bring you optimal solutions.

Since 2009, the advisors at Shoji Investor Relations have developed an evolved skill set from hands on experience accumulated over decades. These skills are needed to guide your company through the overseas challenges, and resolve your strategic problems in order to bring you optimal solutions.Shoji Investor Relations has cultivated overseas relationships, and can source necessary means to accomplish your overseas goals with recognized leaders using their strong capabilities. We will “fill the prescription” for the foundation of your overseas goals that will ultimately lead to true long-term success. As true partners, we at Shoji Investor Relations will guide your company with our total commitment and genuine support for your new market entry, growth, and diversification, which in turn will lead to facilitating success and renewed value capture for your company.

We look forward to engaging with your company, and enhancing your competitiveness and long-term value creation, thereby contributing to greater wealth of our global society.

Maroi Shoji

Principal

“To Promote Greater Value Creation”

Our Value Creating Solutions

We help small enterprises anywhere in the world, which:

- ◆are smart,

- ◆are creative,

- ◆can solve big problems,

- ◆can provide mass customization,

- ◆and have a big potential market

In the shift toward a much more interconnected world, we are seeing the convergence of technologies (5th generation mobile communications, augmented/ virtual/ mixed reality, gene editing, nano-robotics, among others) that will render obsolete 20th century industrial and life science methods, business boundaries, and knowhow.Read more...

We are now seeing the infancy of a grand “Artificial Intelligence of Nano Things and Bio-nano Things”.

Amid such sweeping disruptions, we at Shoji Investor Relations Advisors will provide tailor-made solutions to fit your company’s life stage, and will increase the valuation of especially your less visible assets, namely, corporate organization, strategies, board of directors and other human resources, R&D and marketing infrastructure, in addition to the more obvious elements, such as patents and copyrights. With our foresight, total commitment and hands-on support, we are confident that your company will reap greater value creation, going forward. Show less...

- Strategic Advisory

-

Our Strategic Advisory Services:

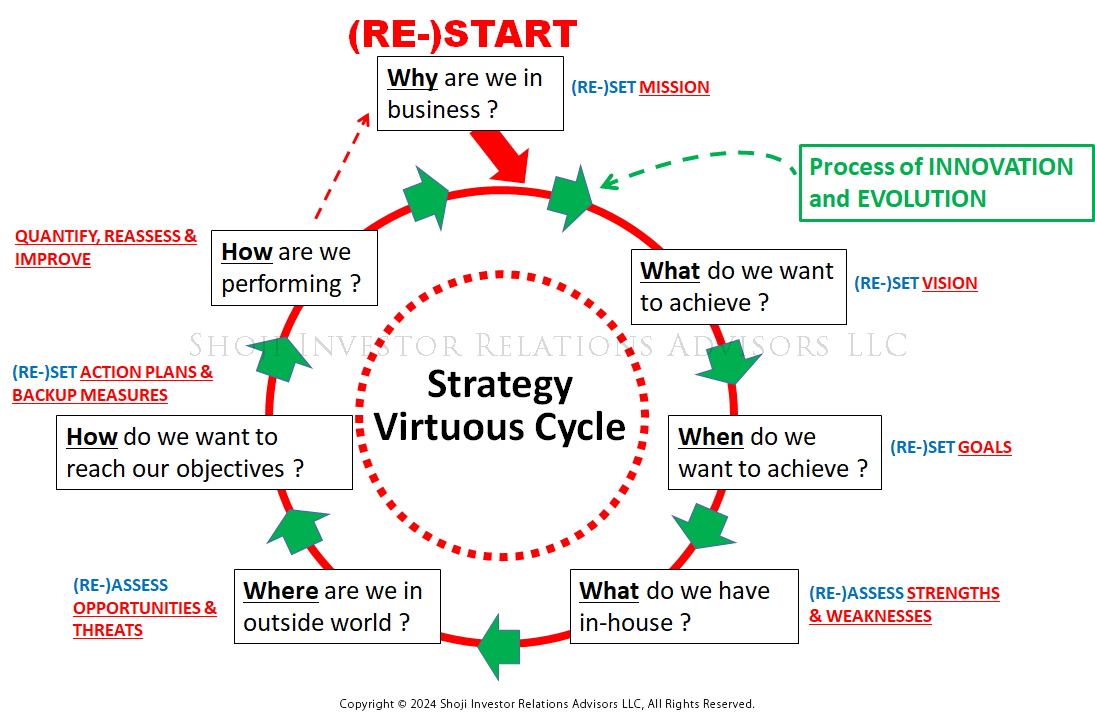

We will set in motion a “strategy virtuous cycle” which, if implemented rigorously and repeatedly, will lead to ongoing innovation and evolution, to maximize value creation.

By improving every activity within the scope of your limited resources, we will draw the roadmap toward true long-term success.

- Technology & Capital Alliances

-

Our Technology and Capital Alliance Services:

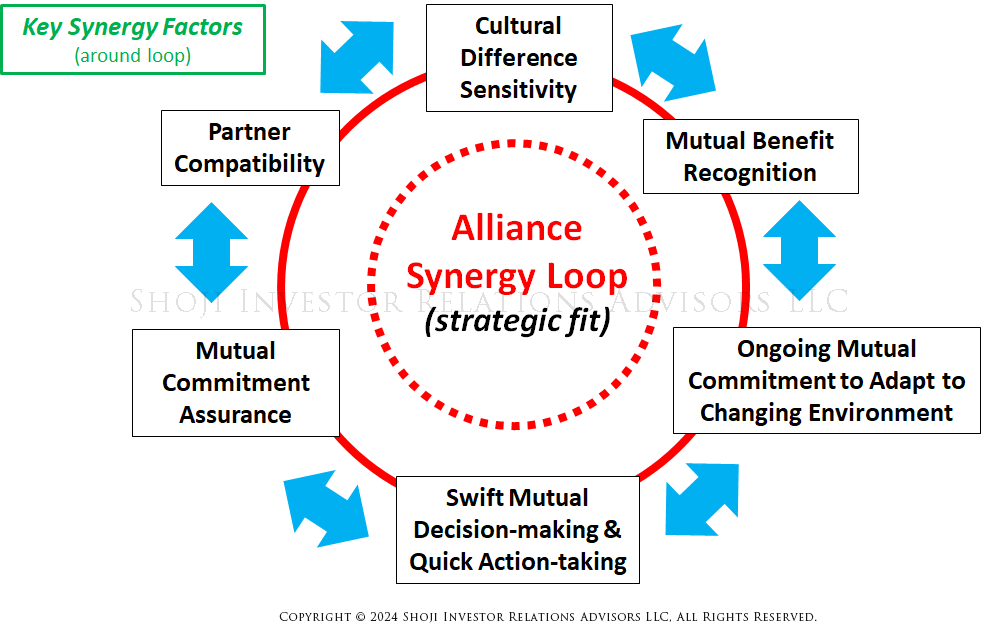

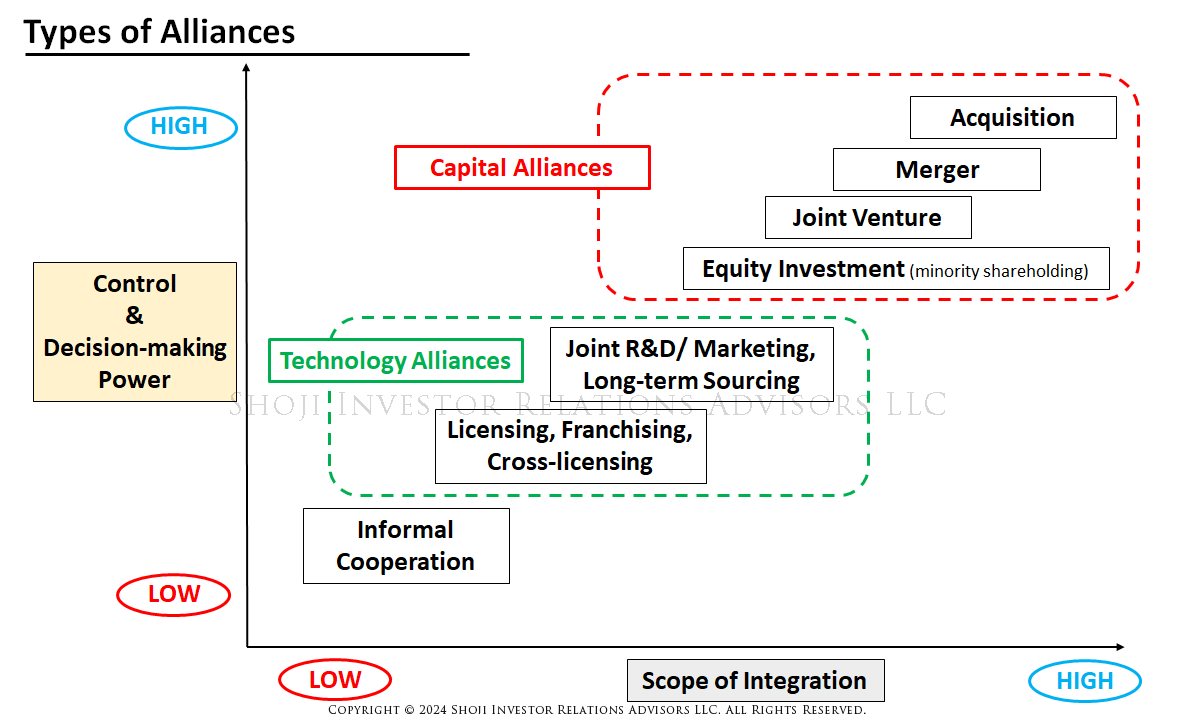

As an extension of our strategic advisory services, we will trigger an “alliance synergy loop”. Depending on the degree of control, decision-making and integration that your company desires and has set under business goals, this loop, if implemented resolutely, will lead to mutual reinforcement of the key synergy factors with your alliance partner.

By focusing on mutuality of the alliance factors (so-called “strategic fit”), we will set the direction toward true long-term success and value creation.

- Private Equity Facilitation

-

Our Private Equity Facilitation Services:

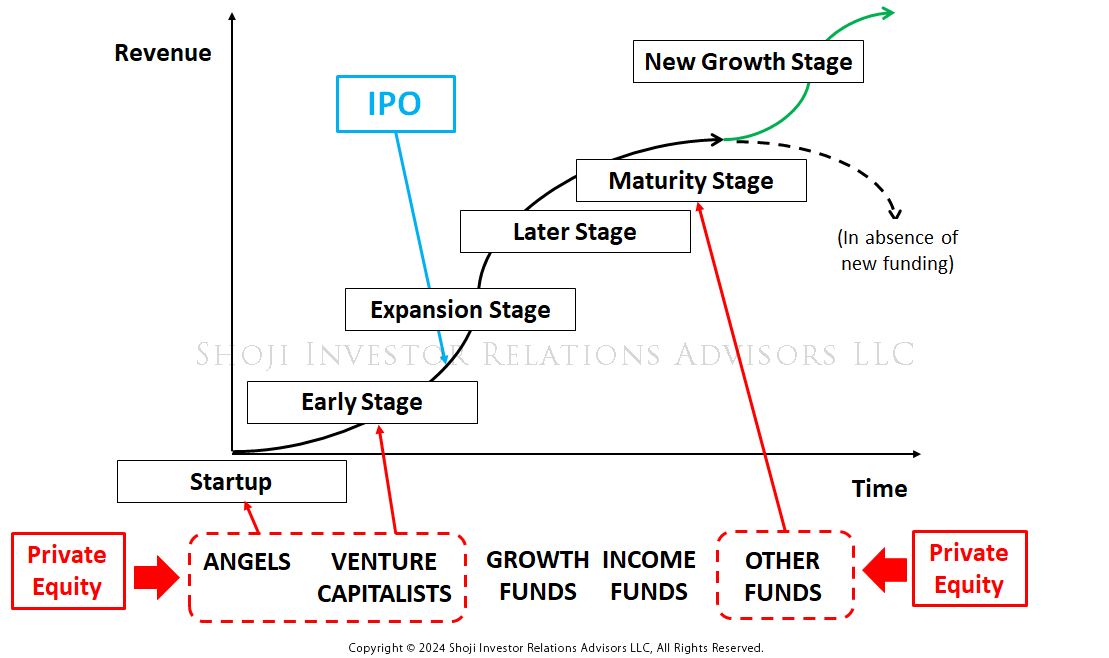

In combination with our other value creation services, we can facilitate private equity participation as an important pivot to achieve your action plans and funding purposes. Depending on your company’s life stage, the capital may be sourced from angel investors, venture capitalists, or other funds.

At the early stage, increased cash at-hand would spur organic growth and business optimization. In later stages, there would be scope for alliances including M&As, to gain key technologies and economies of creativity.

- Corporate Governance

-

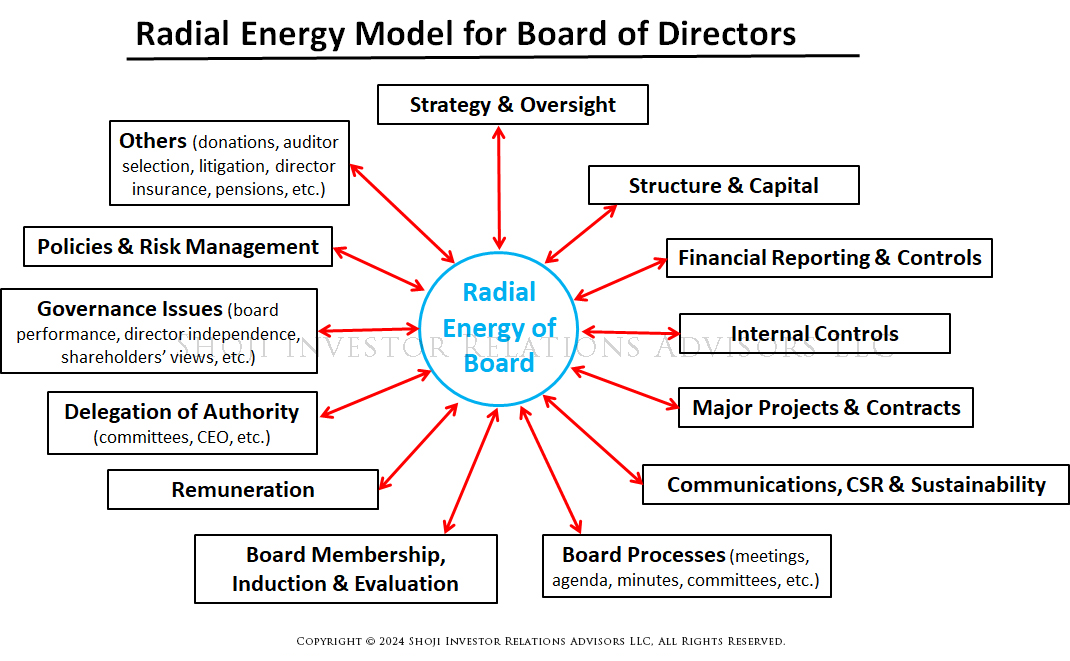

Our Contribution to Corporate Governance:

Based on our objective, neutral and independent viewpoint, we will stimulate and contribute to all functions of the board of directors, using a “radial energy of board” model.

As all company matters start and end at the board of directors, we will reinforce board dynamics (=the source of corporate radial energy). This will lead to upgrading of the status quo, improved collective judgments, better formulation of action plans, an outstanding corporate image, and higher value creation.

- Investor Relations

-

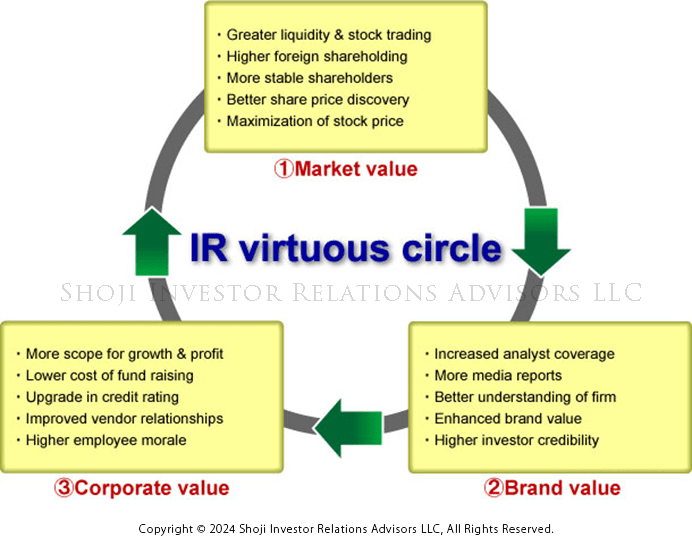

Our Contribution to Investor Relations:

As an extension of our firm’s other services, for listed companies, we will set in motion, or accelerate, a winning path for IR, leading to superior market, brand and corporate value creation, and business performance

Advisors

About Us

- Company Information

- Our Mission & Proposition

Client Successes

Due to our pledge to maintain confidentiality, we are unable to make full disclosures that would implicate a client or third party. However, we outline below a few cases of our key advisory roles.

- Optimal Capture of Investor Risk Appetite

-

Case 1: Optimal Capture of Investor Risk Appetite

Client scenario/ goal: Unlisted company requires funds to build facility for expansion Our ongoing/ evolving role: To facilitate private equity investment, later advised public listing instead Our analysis of recent events: Stock market condition was benign with healthy investor risk appetite, so proposed IPO rather than private equity investments Our recommended future policies: Though stock market lower since IPO, when market returns to sustainable positive trend, will propose another capital increase as investor risk appetite also recovers Our advisory impact: Obtained funding at optimal time within short timespan after deciding on funding policy change Our winning strategy: Funding amount was on target, leading to diversification of investor base Client expectations: Greater value creation, going forward

- Tailoring Technology Pitch to Fit Global Outlook

-

Case 2: Tailoring Technology Pitch to Fit Global Outlook

Client scenario/ goal: To promote proprietary technology and expand global presence Our ongoing/ evolving role: To form alliances through joint ventures, later changed to licensing only Our analysis of recent events: Global macroeconomic outlook adverse, so few companies will invest in new projects of big scale Our recommended future policies: After revenue from licensing fees reaches certain level, should reconsider joint ventures when global economy shows more stability Our impact: Minimized losses amid uncertain global outlook, preserving corporate value Our winning strategy: Higher inflows of licensing fees will spur in-house R&D, producing next generation technologies using our “Strategy Virtuous Cycle”, so poised and ready for next economic upturn Client expectations: Greater value creation with lower risks, going forward

- Adapting to Turnaround in Shareholder Primacy

-

Case 3: Adapting to Turnaround in Shareholder Primacy

Client scenario/ goal: To engage with shareholders as newly listed company Our ongoing/ evolving role: Advise on best global practices for investor relations, later to include enhancing image of transparency and sustainability Our analysis of recent events: World is moving toward higher engagement with all stakeholders, away from shareholder primacy (US Business Roundtable policy change, summer 2019) Our recommended future policies: To ensure disclosures show metrics reflecting sustainable enterprise (trends in CO2 emissions, etc.), policies on human rights and other matters, in line with stricter expectations of stakeholders and investors Our impact: Reduced risks by engaging with activist shareholders, promoting sustainability Our winning strategy: Board enhances corporate governance using our “Radial Energy of Board” model, leading to policies that embrace all stakeholders Client expectations: With enhanced CSR and sustainability image, greater market/ brand/ corporate value creation over long-term using our “Winning Path for IR”, going forward

Professional Affiliations

-

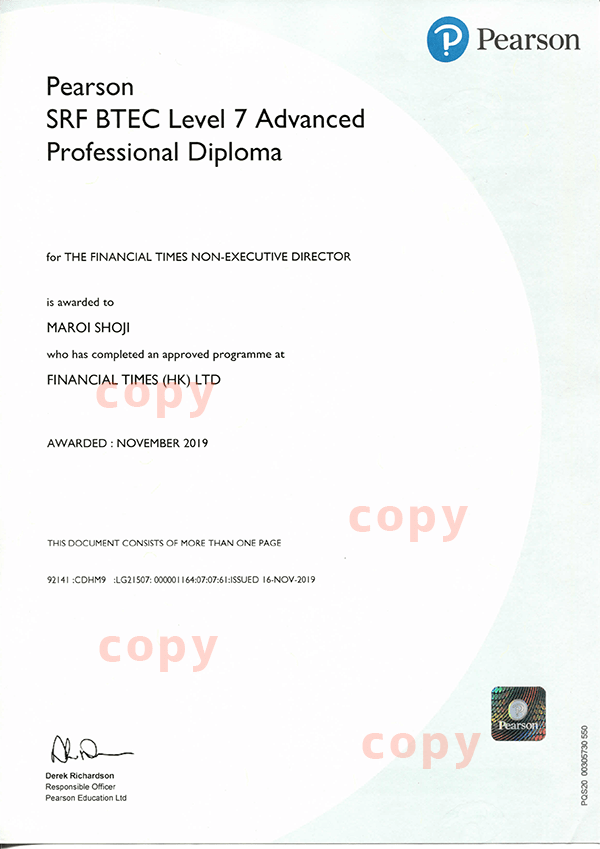

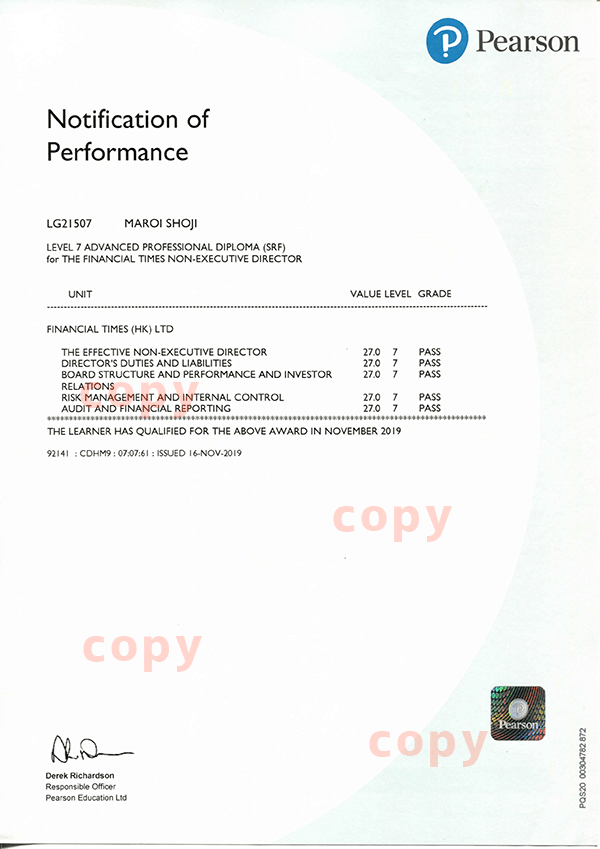

Member of Financial Times Non-executive Directors Club (=alumni association for holders of Nonexecutive Director qualification from Financial Times executive management school)

-

Member of Association of Strategic Alliance Professionals (USA)

-

Member of National Investor Relations Institute (USA)

-

Member of the Japanese Institute of Certified Public Accountants

Inquiries

CHICAGO

EST: +1 hour

PST: -2 hours

LONDON

TOKYO

CONTACT:

| TEL: | +81-3-6630-6040 |

|---|---|

| FAX: | +81-3-6630-6041 |

| Email: | ask@shoji-ir.jp |

Registered head office:

Otsuka 6-34-7, Bunkyo-ku, Tokyo 112-0012, Japan

(Documents should be sent to this address)

Business office:

3rd Floor, Minami-Otsuka 2-11-10, Toshima-ku, Tokyo

(1 minute walk from Shin-Otsuka station Exit 2, Tokyo Metro Marunouchi line)

Inquiries

Copyright © 2024 Shoji Investor Relations Advisors LLC, All Rights Reserved.